Table of Content

The problem with global business payments today

Key benefits of Cleva Business Accounts

Who can use Cleva Business Accounts?

How to open a Cleva Business Account

Frequently Asked Questions about Business Accounts

Introduction

Running a business is already a mission on its own. From closing deals to serving customers, every day is packed with challenges and opportunities. But for many entrepreneurs and SMEs especially in Nigeria, one of the biggest obstacles has almost nothing to do with international customers or products; it’s simply getting paid.

That’s why we’re excited to introduce Cleva Business Accounts, built to give business owners ease and freedom over how they receive and manage their funds globally.

The problem with global business payments today

For too long, business owners have been stuck with limited options:

- Platforms that allow you to receive your payments from abroad but force you to collect it in your local currency.

- Difficulty separating personal funds from business finances, making it hard to stay organized or present professional financial records.

- Stress when taking on large orders because you’re unsure how to receive payments reliably.

- Difficulty in creating a working dollar account for your global business.

The result? Businesses lose value, time, lots of money and opportunities.

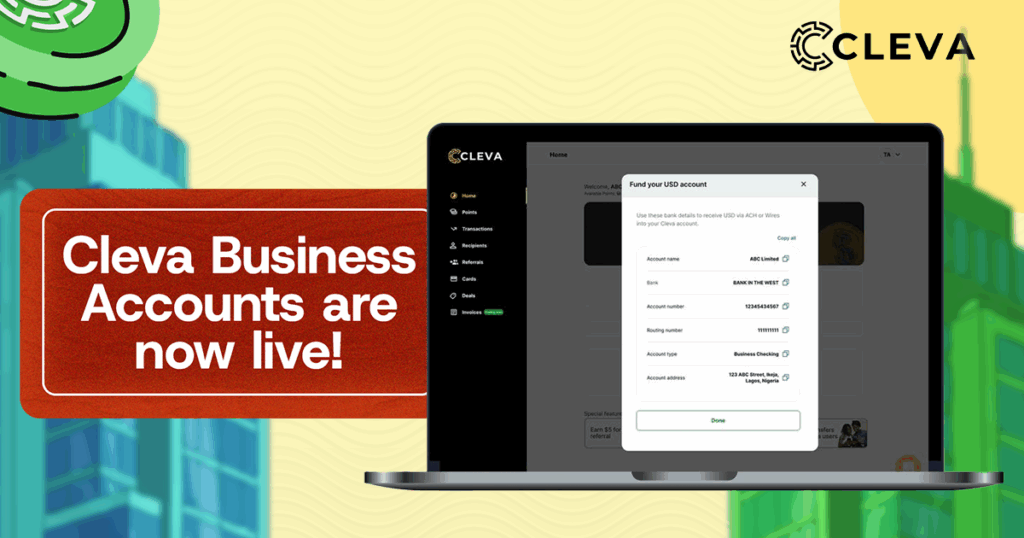

Cleva Business Accounts are designed to solve these pain points and unlock new opportunities for growth. In just a few moments, businesses can open USD and NGN accounts that work seamlessly for both local and international transactions.

With Cleva, you don’t just receive payments, you manage them smarter.

Key benefits of Cleva Business Accounts

Here’s why Cleva Business Accounts are a game-changer for businesses of all sizes:

1. Hold your business funds in USD

Instead of being forced to collect international payments in your local currency, you can now hold your earnings in USD. This protects your revenue from volatility and helps you hedge against inflation.

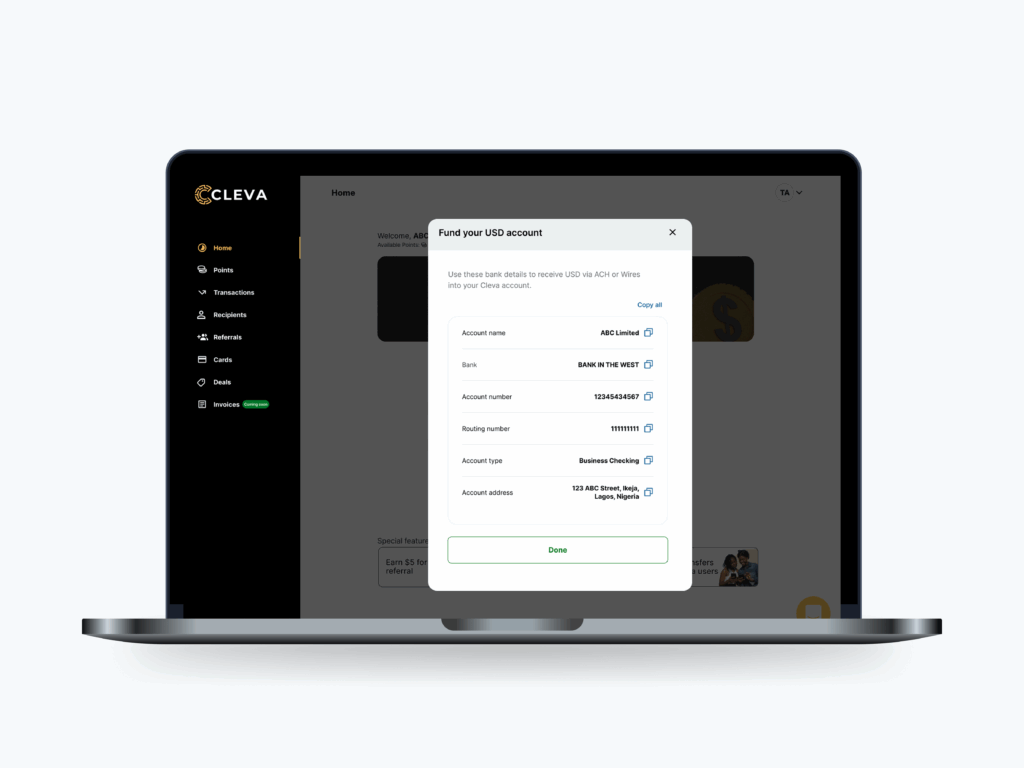

2. Receive payments from clients abroad

Cleva helps your business receive international payments easily and securely, so you can focus on growing your business, not chasing payments.

3. Take on large orders with confidence

Big deals shouldn’t come with big worries. With Cleva, you can accept large payments from global customers without delays or restrictions.

4. Keep business and personal funds separate

No more mixing personal spending with company revenue. Cleva Business Accounts help you stay financially organized, making it easier to track expenses, budget, and scale.

5. Professional statements and records

Access detailed account statements whenever you need them, perfect for bookkeeping, investor reporting, or applying for opportunities that require proof of business income.

Who can use Cleva Business Accounts?

Cleva Business Accounts are designed for but not limited to:

- Freelancers transitioning into agencies or scaling their work.

- SMEs that serve local and international customers.

- Startups that need professional accounts to manage team finances.

- Exporters and online entrepreneurs who want to receive large payments in USD.

If your business earns across borders, this is for you.

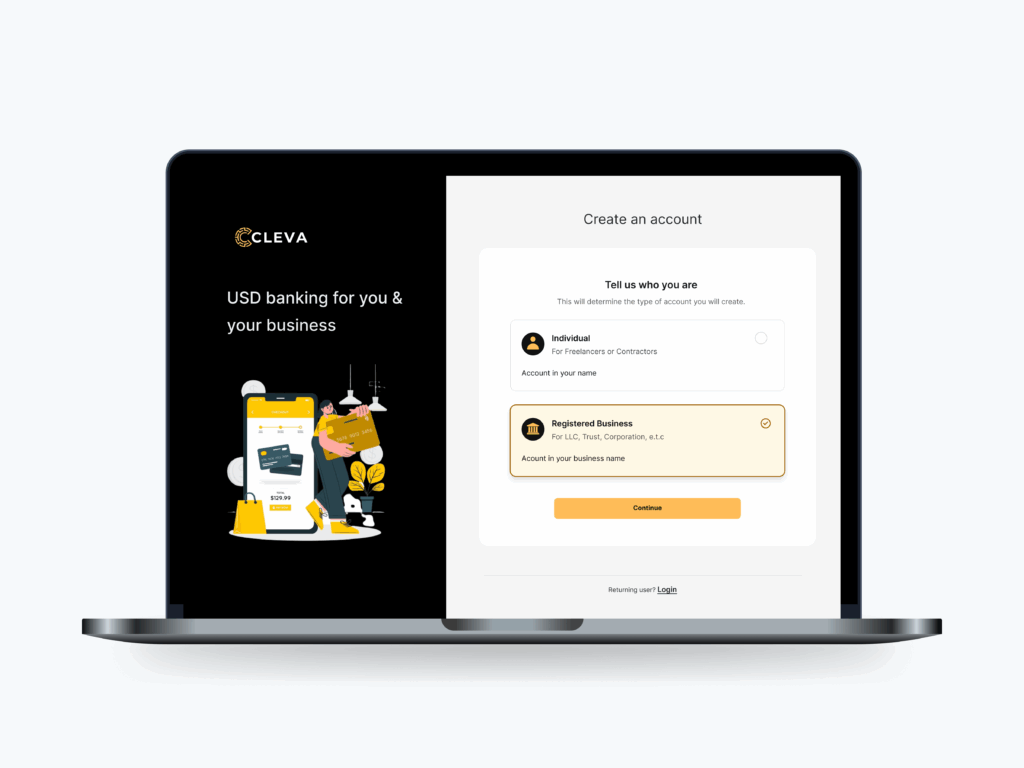

How to open a Cleva Business Account

Getting started is simple:

1. Sign up HERE.

2. Create your business account and submit your business details.

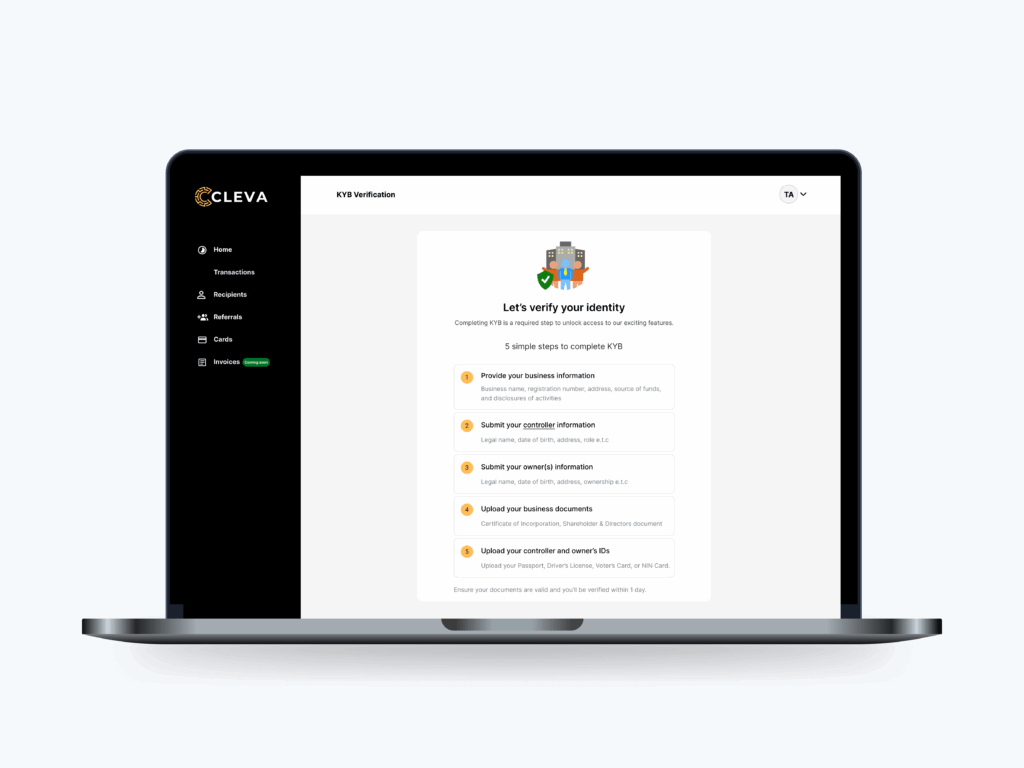

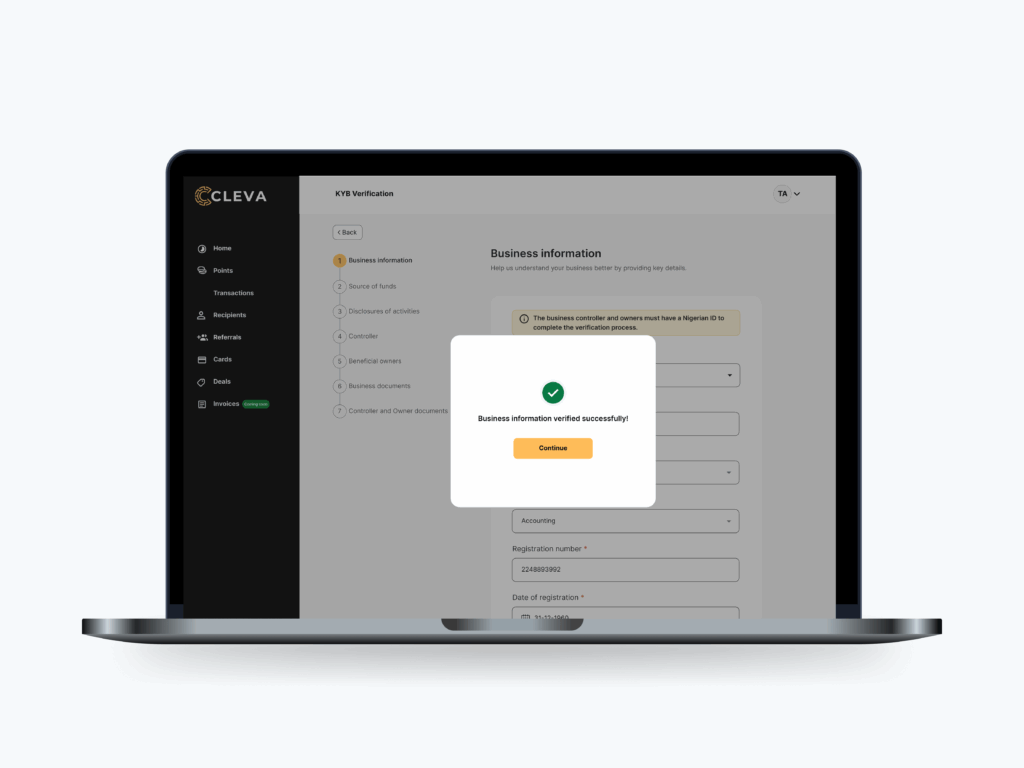

3. Complete your KYB and get verified.

4. Receive your account details and start receiving payments.

In just a few steps, your business is ready to receive, hold, and manage money smarter.

Frequently Asked Questions about Business Accounts

We know you have questions! Here are some answers to get you started:

- What documents are required for a business account?

Answer:

For US businesses, you’ll need:

– Articles of Incorporation

– EIN confirmation letter

– Ownership information for the business

– Proof of address

For Nigeria businesses, you’ll need:

– Certificate of Incorporation

– Shareholders & Directors Report (status report)

– Ownership information for the business

– Proof of address (bank statement or utility bill)

The controller and owners will also need to complete the normal KYC flow by providing a valid government issued ID and proof of address document (only the controller needs to do a liveliness check).

- How long does KYB verification take?

Answer:

Typically 48 hours, but it may take longer if we need additional information.

- What are the transaction limits for businesses?

Answer:

Limits are based on tiers. Please, check your business account to see your tier and your corresponding limit.

- How do I open an account?

Answer:

Simply go to our create account page, select “Registered Business,” and follow the process.

- Can I access my business account in the Cleva app?

Answer :

No. You can only access the business account on the Web app.

- Is Business Account live for Uganda and Ghana too?

Answer:

Currently, Cleva Business Accounts are available only for US and Nigeria-registered businesses. We also only support business controllers and owners who are Nigerians for now.

- Can Business Accounts receive stablecoins and earn Points?

Answer:

Yes, Cleva Business Accounts can receive USDT & USDC deposits, and Cleva Points apply to business users as well.

Conclusion

The launch of Cleva Business Accounts is more than just a new product, it’s a shift in how African businesses can participate in the global economy.

By giving entrepreneurs the ability to hold funds in USD and manage large payments, Cleva is empowering African businesses to grow without limits.

With Cleva Business Accounts, you can finally run your business with financial clarity and growth in mind.

Share this article