3 years ago, cross-border B2B payments meant accepting a week of delays, hidden fees and exchange rates that changed by the hour. Today, that same payment can clear in a day. And soon? It may happen in minutes.

Global B2B payments are transforming faster than most business owners realize. Cross-border transaction volumes reached approximately $190 trillion in 2023, including $146 trillion in wholesale payments and $44 trillion in retail B2B and consumer payments, with B2B transactions alone accounting for $39 trillion.

The more important shift, however, is not volume. It is the fundamental redesign of the infrastructure that moves money across borders. If you’re still thinking about international payments the way you did in 2022, you’re already behind.

These changes are not just about speed. They are about how businesses manage multi-currency cash flow, reduce risk, and operate confidently in global markets. What follows is a clear breakdown of the most important trends shaping global B2B payments today and what they mean for cross-border businesses.

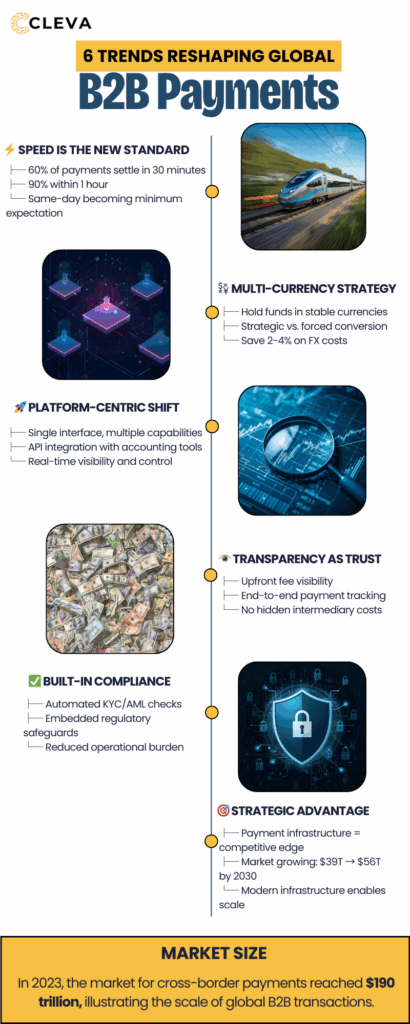

1. Speed is becoming the minimum standard for cross-border B2B payments

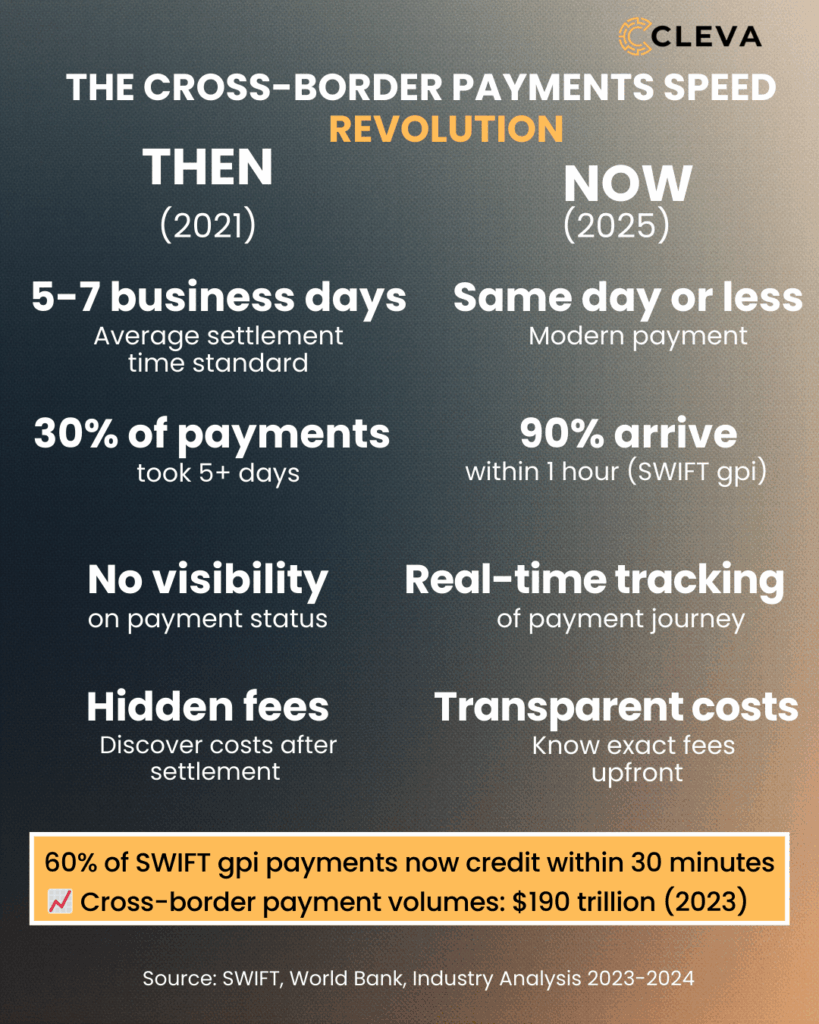

Speed is now the baseline expectation for global B2B payments. International transfers that once took 3 to 7 business days are increasingly expected to settle within 1 business day or less.

For decades, slow settlement times were accepted as unavoidable. Intermediary banks, batch processing, and limited operating hours defined cross-border payments. Businesses designed their cash flow around these delays because there were no viable alternatives.

That assumption no longer holds.

Payment systems like SWIFT gpi (which processes 60% of payments within 30 minutes), real-time rails such as SEPA Instant in Europe and FedNow in the United States, and blockchain-based solutions have reset expectations. According to recent SWIFT data, 90% of cross-border payments now reach the destination bank within one hour.

While instant settlement is not yet universal for all corridors, the direction is clear. Same-day or next-day settlement is quickly becoming the norm.

This shift has direct operational consequences. Faster settlement improves working capital efficiency, reduces idle cash buffers, and allows businesses to align payments more closely with delivery milestones. It also changes supplier dynamics. In global markets, suppliers increasingly prioritize partners who can pay quickly and predictably.

For cross-border businesses, speed is no longer a “nice to have.” It is becoming a prerequisite for trust and scale.

This is where USD-denominated accounts play a critical role. Instead of routing payments through multiple correspondent banks, businesses that hold USD balances can settle obligations directly, reducing friction and delays. Cleva Business USD Accounts enable Nigerian businesses to receive, hold, and use dollars without relying on traditional international wires, helping them move at the pace global commerce now demands.

TL;DR: Why speed in B2B payments matters

- Same-day settlement is replacing 3-7 day waits as the global standard

- Faster payments improve working capital by reducing idle cash

- Holding USD accounts eliminates routing delays through correspondent banks

In Practice

Consider a Nigerian manufacturing company that imports raw materials from China and exports finished goods to US buyers.

Under traditional banking

- Payment to Chinese supplier: 5-7 business days

- Payment from US buyer: 3-5 business days

- Working capital trapped: 8-12 days minimum

With Cleva

- Receive USD from US buyers directly into Cleva USD account

- Hold USD balance without forced NGN conversion

- Pay Chinese suppliers in USD with 1-3 day settlement

- Working capital cycle reduced from 8-12 days to 4-6 days (approximately 50% improvement)

This speed advantage compounds. Faster payments mean the company can negotiate better terms with suppliers, take advantage of early payment discounts, and respond quickly to market opportunities.

2. Multi-currency complexity is forcing a rethink of cash flow management

Multi-currency cash flow is now one of the biggest operational risks for cross-border businesses. Global businesses do not fail because they lack revenue. They fail because they cannot manage cash flow across currencies.

As businesses expand internationally, they are exposed to a new layer of complexity. Revenue might come in USD, GBP, or EUR, while expenses are split across local currencies. Exchange rate volatility adds uncertainty, and forced conversions often happen at rates 2-5% worse than mid-market rates. The World Bank reports that the average cost of sending $200 internationally was 6.2-6.3% in 2023, with fees to Africa often exceeding 7%, costs that directly impact business margins.

Historically, many businesses handled this by converting funds immediately, accepting poor rates just to simplify accounting. That approach is becoming increasingly costly.

Modern B2B payment infrastructure is shifting toward multi-currency holding and strategic conversion. Instead of converting on receipt, businesses can now hold funds in stable currencies like USD and choose when to convert based on cash flow needs and market conditions.

This changes how finance teams think about liquidity.

It also simplifies budgeting for global subscriptions, software, contractors, and suppliers who price in dollars.

Cleva’s USD accounts are designed around this reality. By allowing businesses to receive USD payments and keep them in USD, Cleva helps companies separate revenue management from currency conversion decisions. This flexibility is becoming a core requirement for any business operating across borders.

Key Takeaways

- Foreign exchange volatility erodes profit margins by 2-4% on average

- Holding USD enables strategic, not forced, currency conversion

- Predictable cash flow improves financial planning and confidence

⚠️ Note on Multi-currency strategy: While full multi-currency accounts (holding EUR, GBP, etc.) remain limited in many African markets, USD accounts provide the most critical currency holding capability for cross-border businesses. Since the majority of international trade, SaaS subscriptions, and digital services are priced in USD, holding USD addresses 70-80% of the multi-currency challenge for most businesses.

Case Study: Export-focused business managing USD revenue

A Lagos-based software consulting firm serves primarily US-based clients:

Revenue streams

75% USD (US corporate clients), 25% NGN (local contracts)

Before Cleva USD accounts

- Received USD via PayPal or traditional wire transfers

- PayPal fees: 4-5% per transaction

- Wire transfer fees: $25-50 per transaction plus 2-3% FX spread

- Forced immediate conversion to NGN at unfavorable rates

- Annual payment processing costs: ~$48,000 on $800K USD revenue

- Unpredictable cash flow due to rate volatility

Expense structure

40% USD (cloud infrastructure, software licenses), 60% NGN (local salaries and operations)

With Cleva USD accounts

- Receives USD payments directly into Cleva account

- Holds USD for international SaaS subscriptions and infrastructure costs

- Pays AWS, Google Cloud, GitHub directly in USD without conversion

- Converts to NGN strategically for salary payments

- Reduced payment processing costs to under 1.5%

- Annual savings: ~$36,000

3. B2B payment infrastructure is shifting from bank-centric to platform-centric

Global B2B payments are moving away from bank-centric models toward platform-centric infrastructure. This shift is redefining who controls the payment experience.

Traditional cross-border payments relied on chains of correspondent banks. Each intermediary added cost, delay, and opacity. Businesses had little visibility into where funds were or when they would arrive. However, that model is being replaced.

Modern payment platforms like Cleva, Wise Business and Payoneer abstract this complexity. Instead of interacting with multiple banks, businesses engage with a single platform that handles routing, compliance, settlement, and reporting behind the scenes, something traditional correspondent banking chains cannot offer.

This matters because control of the interface enables optimization. Platform-centric systems are designed around business workflows, not legacy banking constraints. They integrate more easily with accounting tools, provide clearer transaction visibility, and adapt faster to changing business needs.

Cleva fits squarely into this platform-led future. Rather than behaving like a traditional bank, Cleva provides businesses with USD accounts for free and cards built for global operations. The result is fewer handoffs, clearer visibility, and greater control over cross-border money movement.

4. Transparency in cross-border payments is replacing opacity as the trust currency

Ask any business that pays international suppliers what they fear most, and the answer is rarely speed alone. It is uncertainty.

- Where is the money?

- How much will actually arrive?

- What fees were deducted along the way?

- When will the supplier receive it?

Traditional cross-border payments rarely answered these questions clearly. A payment might show a “$25 wire fee” but arrive $80 short due to intermediary bank deductions and unfavorable exchange rates. Research shows the true cost of sending $200 internationally averages 6.2-6.3%, but these costs are often discovered only after settlement. Businesses only discovered the true cost of a transaction after it settled, often days later.

This lack of transparency eroded trust and complicated financial planning.

Today’s B2B payment systems are moving in the opposite direction. Businesses increasingly expect upfront visibility into fees, exchange rates, and settlement timelines. They want to know exactly what will happen before they send money.

This trend is driven partly by competition and partly by necessity. As more businesses operate globally, opaque payment systems become operational risks rather than inconveniences.

USD account-based systems improve transparency by reducing unnecessary conversions and intermediaries. When businesses transact in the same currency they hold, costs are clearer and outcomes more predictable.

By giving businesses direct access to USD balances, Cleva reduces hidden fees and improves visibility across international transactions. Transparency becomes a built-in feature rather than an after-the-fact discovery.

Key Takeaways

- Hidden fees create operational and trust risks.

- Fewer intermediaries mean clearer outcomes.

- Transparency strengthens supplier confidence.

5. Compliance and Regulation are becoming built in, not an afterthought

Compliance is now embedded directly into modern payment infrastructure. For a long time, compliance sat at the edges of cross-border payments. Businesses focused on getting money in and out, then dealt with regulatory questions only when something went wrong. However, that approach no longer works.

As global B2B payments scale, regulators are paying closer attention to how money moves across borders, who is sending it, and where it ends up. This has led to stricter requirements around KYC, AML, transaction monitoring, and reporting across multiple jurisdictions.

For businesses, this creates a new challenge.

Managing compliance manually across countries is expensive and risky. Different markets have different rules, and a single compliance gap can delay payments, freeze accounts, or disrupt operations entirely.

The trend now is toward compliance being embedded directly into payment infrastructure rather than handled separately by each business.

Modern payment platforms are building regulatory safeguards into their systems by default. Identity verification, transaction screening, audit trails, and reporting are handled at the platform level, reducing the burden on businesses while increasing overall trust in the system.

This shift is especially important for cross-border businesses in emerging markets. Access to global financial systems increasingly depends on meeting international compliance standards, not just local ones.

By providing regulated USD accounts for businesses, platforms like Cleva help companies operate globally without constantly navigating complex regulatory processes on their own. Compliance becomes part of the infrastructure, not a recurring operational headache.

For growing businesses, this means fewer surprises, fewer disruptions, and more confidence when working with international partners.

6. B2B payments infrastructure is becoming a strategic competitive advantage

Payment infrastructure decisions now directly influence competitive positioning. The B2B cross-border payments market is projected to grow from $39 trillion in 2023 to $56 trillion by 2030, driven largely by businesses that have modernized their payment operations.

Businesses with modern infrastructure can pay suppliers faster, manage funds in stable currencies, reduce friction, and plan cash flow across markets. Those without it face slower operations, higher costs, and constrained growth.

USD-denominated business accounts are becoming foundational to global participation. They allow businesses to operate on equal footing with international partners.

Cleva enables Nigerian and US businesses to compete globally by providing USD accounts built specifically for cross-border operations. When payments work seamlessly, businesses move faster, make better decisions, and scale with fewer constraints.

Example:

Consider a Nigerian e-commerce business selling to US customers and sourcing inventory from Chinese manufacturers. With traditional banking, they face 5-7 day settlement times and conversion losses of 3-5% on each transaction. Using USD accounts through Cleva, they can receive USD from US sales directly, hold those funds, and pay Chinese suppliers in USD with 1-3 day settlement, eliminating unnecessary conversions and reducing the payment cycle by 40-50%.

The strategic advantage is subtle but powerful. When payments work seamlessly, businesses move faster, make better decisions, and scale with fewer constraints.

In Summary

- Global B2B payments are being fundamentally redesigned.

- Speed, transparency, and compliance are becoming baseline expectations.

- Easy access to USD is now essential for cross-border businesses.

- Payment infrastructure directly affects scalability and competitiveness.

What these trends mean for your cross-border business

Taken together, these trends point to a clear reality. Global B2B payments are not just improving. They are being re-architected.

For cross-border businesses, this changes what “good enough” looks like.

It is no longer sufficient to simply move money internationally. The businesses that succeed over the next few years will be those that:

- Reduce exposure to FX volatility by holding funds in stable currencies.

- Eliminate unnecessary intermediaries and opaque fees.

- Build financial operations that scale across borders without constant friction.

- Choose infrastructure that supports growth rather than limiting it.

Frequently Asked Questions

1. How can I open a USD account for my business in Nigeria?

You can open a USD account for your business through Cleva. Cleva provides regulated USD business accounts that allow Nigerian and African businesses to receive, hold, and use US dollars for cross-border transactions without relying on traditional international bank transfers.

2. What is a USD account and why do cross-border businesses need one?

A USD account allows businesses to receive and manage payments in US dollars. Cross-border businesses need USD accounts to reduce foreign exchange risk, simplify international payments, and maintain predictable cash flow when working with global customers and suppliers.

3. How does Cleva’s USD account support cross-border businesses in practice?

Cleva’s USD accounts are built for businesses that transact internationally in US dollars. If you run an e-commerce business selling to US customers, provide services to international clients, or import inventory from overseas suppliers, Cleva allows you to receive USD payments directly and hold them in your USD account. You can use these funds to pay international suppliers, cloud service providers, or software subscriptions, all without forced conversion. When you need NGN for local expenses, you convert strategically rather than automatically, helping you manage FX exposure more effectively.

4. Are Cleva’s USD accounts compliant for businesses?

Yes. Cleva’s USD business accounts are fully compliant with international Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements in both Nigeria and the United States, allowing businesses in these markets to operate globally while meeting regulatory standards.

5. What should businesses look for in cross-border payment infrastructure?

Businesses should look for fast settlement, transparent fees, regulatory compliance, access to USD accounts, and seamless integration with existing financial operations. Platforms like Cleva are designed to support these needs as businesses scale across borders.

6. What documents are required to open a Cleva business account and how long does verification take?

The required documents depend on where your business is registered.

For U.S. businesses, you’ll need Articles of Incorporation, an EIN letter, ownership information, and proof of address.

For Nigerian businesses, you’ll need a Certificate of Incorporation, Status Report, ownership information, and proof of address.

KYB verification typically takes up to 48 hours, but it may take longer if additional information is required.

Conclusion

The most important shift is this: payments are no longer an operational expense. They are an operational lever that can unlock speed, trust, and scale. Platforms like Cleva reflect this new reality. By giving businesses access to USD accounts designed for cross-border operations, Cleva helps companies move beyond survival tactics and into sustainable global growth.

The infrastructure powering global B2B payments is changing whether businesses are ready or not. The real question is whether your business is positioned to benefit from this shift or constrained by outdated systems.

Cleva exists to help businesses choose the former.

If you’re building a cross-border business and need a better way to receive, hold, and use USD, you can open a Cleva business account and start operating on modern global payment infrastructure.

Share this article