Introduction

You finally landed your first international remote gig as a freelancer. Congratulations!

Now comes the real challenge. How do you receive your USD quickly, safely, and at a good rate without losing a big chunk to fees and unfavourable exchange rates?

For many Nigerians, the dream is simple. Earn in dollars, spend in naira, and build your life right here at home. But most platforms were not designed for Nigerian freelancers, and it is already hard enough fighting stereotypes and working twice as hard just to secure the job as a Nigerian. Then the next battle begins. You are trying to receive your money without losing it to high fees, poor rates, or platforms that treat your dollars like spare change.

Every time you check “how much is dollar to naira today,” or “what is the dollar rate in Nigeria now?”, you are not just curious. You are calculating. Because the difference between a good rate and a bad one could mean paying rent on time or scrambling at month end. Many platforms come with hidden charges that quietly reduce your earnings, but better options now exist.

If you want a platform that lets you receive USD payments directly to your bank account in Nigeria as a freelancer, Cleva is built for you. In this guide, we will compare Cleva with the most common USD payment platforms and show how you can keep more of what you worked hard for.

Also read: How to open a dollar account in Nigeria with ease

Top platforms for USD payments in Nigeria

Before choosing where to receive your USD, it helps to understand what actually affects your earnings as a freelancer. The account type you get, the fees you pay, where you can receive money from and the exchange rate your platform uses all impact how much 1 dollar to naira is worth by the time it hits your account.

Most platforms tick one or two boxes. Cleva is one of the few that covers everything freelancers truly care about. Here’s what sets Cleva apart.

| Platform | Account Type | Fees and Costs | Exchange Rate | What you are really getting |

| Cleva | Individual US USD Bank Account | 0.8% fee (min – $1, max – $10), FREE Upwork deposits, FREE USDC/USDT deposits, Redeemable Points on deposits | Favourable and affordable rates | Your own US bank account that can be created in minutes from the comfort of your home, zero fees on Upwork, rewards program that pays you back in USD, fast withdrawals, built specifically for Nigerian freelancers |

| Grey | Virtual Multi-Currency | Fees on every deposit | Standard | Good for multi-currency needs but you pay for every transaction |

| Geegpay | Virtual Multi-Currency | Fees on every deposit | Standard | Good for multi-currency needs but you pay for every transaction |

| Payoneer | FBO/Processor Account | High ($29.95 annual fee, withdrawal fees) | Standard | Wide integration but expensive, especially for regular freelancers |

Why 500,000+ users trust Cleva to receive their USD payments

Cleva isn’t just another virtual account. With over half a million users, it’s the go-to platform for Nigerian freelancers, creators, remote workers and businesses who want fast, secure, and cost-effective access to their USD earnings. Here’s why:

1. Individual USD bank account

Unlike competitors that offer FBO (For Benefit Of) or shared accounts, Cleva provides a real US bank account in your name. This gives you full ownership and control over your funds, removing hidden fees and maximizing what you keep. You can open your Cleva account from the comfort of your home and within minutes

2. Lower fees and transparent pricing

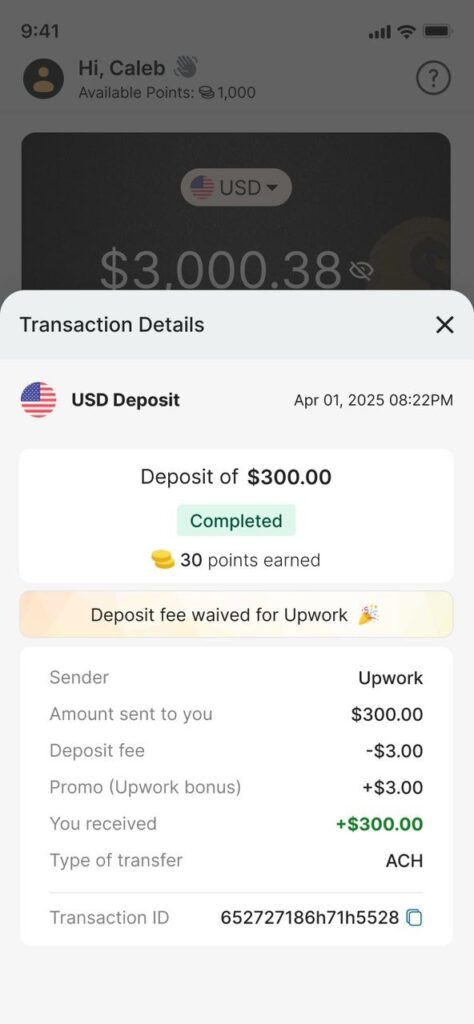

- Free Upwork deposits and free USDC/USDT stablecoin deposits

- Competitive capped fee of 0.8% (minimum $1, maximum $10)

You always know what you’re paying, whether it’s $200 or $5,000, unlike other platforms with hidden charges that quietly eat into your earnings. You can even calculate exactly how much you’ll receive on our pricing page before withdrawing, giving you full clarity and control.

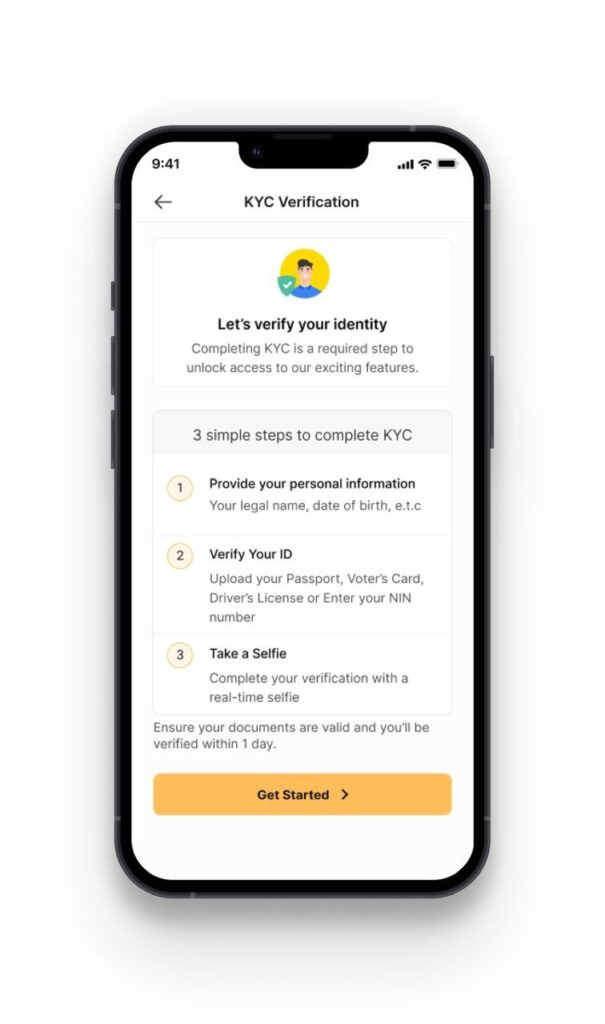

3. Fast and easy KYC

With Cleva, you don’t have to worry about long queues or heavy paperwork. Cleva’s online KYC process gets your account ready for payments easily, so you can focus on your work, not bureaucracy.

4. Competitive exchange rates

Cleva offers competitive, transparent rates, so you can calculate exactly how much your dollars are worth before withdrawing.

5. Earn as you go

Cleva rewards your hard work. Every time you receive a payment, you earn points redeemable as USD, giving you extra value just for getting paid.

6. Instant access and flexible withdrawals

Receive payments directly to your account and withdraw to Nigerian banks quickly. You don’t have to deal with slow traditional banks anymore.

7. Built for Nigerian freelancers

Every feature of Cleva, from fees to onboarding to rewards, was designed with Nigerian freelancers and remote workers in mind. You get control, convenience, and transparency all in one platform.

How to get started with Cleva as a freelancer

Getting Started is easy. Opening your Cleva account takes just a few minutes:

- Sign up online: Visit Cleva’s website or download the app on iOS or Android.

- Complete KYC : Verify your identity with your BVN, valid ID, proof of address, and a selfie.

- Access your USD account instantly: Receive payments from Upwork, Fiverr, or direct clients.

- Withdraw or spend: Convert to naira or hold in USD, all with transparent, competitive rates.

Once you’re set up, you can start taking full control of your USD payments while enjoying Cleva’s unique features.

Understanding the Dollar to Naira exchange rate for freelancers

Your real earnings depend on the exchange rate you get when converting USD to NGN. Many freelancers track:

- Official CBN rate: The government benchmark

- Black market rate: Reflects real supply and demand

- Platform rate: Determines how much your USD is actually worth after conversion

Cleva keeps it simple. With competitive rates and transparent pricing, you can plan withdrawals and maximize your income.

Why domiciliary accounts are no longer ideal for a freelancer

Traditional domiciliary accounts were once the only option for receiving USD in Nigeria. But for modern remote work, they fall short:

- Slow onboarding: Branch visits, long queues, and heavy paperwork

- High fees: Expensive SWIFT charges and poor conversion rates

- Limited flexibility: Not optimized for freelancers or digital payments

Cleva solves these problems with fast online KYC, instant rewards, and transparent, cost-effective payments.

Conclusion

Choosing the right platform means more money in your pocket and less stress. Cleva simplifies receiving your international payments and ensures you have a transparent, cost-effective tool to manage your earnings, regardless of the fluctuating USD to Naira market.

By choosing a solution built specifically for the Nigerian freelancer, you gain control over your money, ensure fast deposits (like our free Upwork deposits), and secure the most competitive conversion margins. Sign up on Cleva to take full control of your earnings and make every dollar count.

Share this article